Jul 23, 2008 I use iBank and Im very happy with that small application. It usually convert all formats just fine. I'm downloading quicken files from my bank and they are imported into the iBank without any problems. I would really recommend iBank to all mac users. Version 2 was not bad but had many shortcomings. 3.1 is really nice. Convert from Quicken for Mac to Quicken for Windows Important: The option to convert data from Quicken for Mac to Quicken for Windows is available, but completing this conversion with a file that contains investment accounts may result in investment data loss.

Sep 01, 2020 Quicken for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you're not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less.

I switched to a Mac in early 2005 and although I don't see myself ever willingly going back to Windows at home (I use it at work), the one area that makes me wish I was on a PC is personal finance software. I've been a Quicken user since 2000 and have enjoyed the benefits of easily tracking my spending, budgeting, online bill pay and cash flow forecasting for almost all of my adult life. I can still remember pondering the switch to Mac and thinking, 'oh great, they have Quicken for Mac.' But that was the last time I thought of a product from Intuit in a positive light. Converting from Quicken for PC to Mac was one of the most difficult software migrations I've ever done — and I do them for a living. I spent countless hours on the phone with support trying to figure out why my registrars didn't balance when I imported my qif files — no, Intuit doesn't support a direct import, but rather you export everything and import it back in. In the end I made the transition and missed the superior PC version of Quicken, holding my breath as Intuit released paid upgrades to its Mac product, only to realize none of my beefs were addressed.

But hey, at least it worked and it had many of the same features I had in the PC world, that was until Lion came along. Faced with the choice to upgrade to Quicken Essentials or to not upgrade to Lion, I bit the bullet and hoped for the best. That hope was unfounded as I lost access to one of my favorite features, online bill pay. For the past 10 years I've entered a transaction into Quicken and had it paid by my bank automatically, but not anymore. Now I have to enter the transaction into my bank's website and then enter it again into Quicken — if I wait for the transaction to clear, which will enter it automatically, I don't have the ability to forecast my cash flow. That is bad enough, but the budget tool in Quicken Essentials does not work, I won't go over the details here, but the issues are well documented in the Intuit community forums.

And so last month I decided to get serious about budgeting and while a spreadsheet does a pretty decent job at a high level, tracking my day-to-day spending against the budget on a spreadsheet is anything but workable. At first I tried HomeBudget for the iPhone and while it was ok, I found it tedious to enter each transaction manually since it doesn't link to my bank account. Then there was the Mint upgrade this month, which added budget features, so I figured now was a time to try it again. Mint is actually pretty good at keeping tracking of spending with a great iPhone app and website. I can quickly open it on the go and categorize my spending and see how I'm doing vs my goals in that category. I haven't tried it a whole month yet, but I'm hopeful it'll fit this specific need. The problem is, it only fits this one need, and not all my needs as it doesn't do cash flow forecasting, at all, or bill pay. I can't even work on a budget until the month begins — typically I like to get it worked out at least a few days in advanced.

So here I am over two years after Quicken Essentials was released realizing that Intuit is never going to fix it, never going to add online bill pay and never going to add an iPhone app that syncs automatically. So instead I'm using four applications to do what I used to do with a single app (bank site for bill pay, Quicken Essentials for cash flow forecasting and reconciliation, Mint to track day-to-day spending, and Google Docs for my monthly budget).

Convert From Ibank To Quicken For Mac Os

In July, I wrote in Using Quicken for Mac? Read This Before You Upgrade to Lion about issues that I – along with any Mac user running an older copy of Intuit's Quicken personal finance software – would be having when upgrading to OS X 10.7 Lion.

Migrating to Quicken Essentials

Briefly, Lion no longer includes Rosetta, Apple's software that, in previous versions of OS X, allowed Intel Macs to run software created for earlier PowerPC Macs. Although all Macs have used Intel CPUs since 2006, Intuit coded all Mac versions of Quicken prior to the current Quicken Essentials 2010 for PowerPC. Moreover, the Quicken File Exchange utility included with the current version of Quicken – used to import data from earlier versions or Windows versions – is also compiled for PowerPC Macs. As a result, Quicken 2005 (which I was running), Quicken 2007, and the Quicken File Exchange utility won't run on a Mac running Lion.

Intuit has not been especially helpful to its Mac user base; the company's advice to users with this problem is to open an account with Intuit's Mint.com online financial service. The problem: It doesn't import existing financial data. Otherwise, Intuit suggests users install Windows on their Mac (perhaps using one of several virtualization programs) and run the Windows version of Quicken.

Intuit does have a Mac product, Quicken Essentials 2010, which will run under Lion – and which will import Quicken 2007 exported data, as long as the data is imported into Quicken Essentials prior to installing Lion Hp zr30w specifications. (since, as I mentioned above, the Quicken File Exchange utility requires Rosetta, and hence won't run under Lion).

In the July article, I walked users through the process I went through of exporting and importing my Quicken data – something that I did prior to upgrading to Lion.

Disenchanted with Quicken Essentials

Although I was able to successfully import my financial data into Quicken Essentials, I quickly became disenchanted with the program.

Convert From Ibank To Quicken For Mac Online

My needs in financial software are fairly basic. I need something that lets me enter expenses and income, keeping a balance, and assigning each item into a category. Quicken Essential does this fine.

Quicken Essentials 2010 for Mac

But I also need to be able to create a report for each year, showing my expenses and income by category, and totaling each category. This is helpful when filing my income tax return.

And unlike the 2005 version of Quicken I was previously using, Quicken Essentials 2010 doesn't let me do that. It has a menu item labeled Export Tax Report – but that creates a report that can be used only by Intuit's companion TurboTax software, and only in the US. (I'm in Canada.)

I could, I discovered, display just the current year's transactions, then export to CSV (Comma Separated Values) format, a standard text file format that can be imported into a spreadsheet like Microsoft Excel. In Excel, I could sort the data by category, then manually total up each category, and eventually end up with something approximating the reports that I could quickly create in the earlier version. But that's a lot of effort.*

(It's not like this is a particularly advanced requirement. Prior to using Quicken 2005, I was a running the 3.0 version of Microsoft Money, a piece of Windows software so old that it shipped on a single floppy diskette.)

Luckily, Quicken Essentials 2010 ($50) is not the only option for Lion users.

iBank

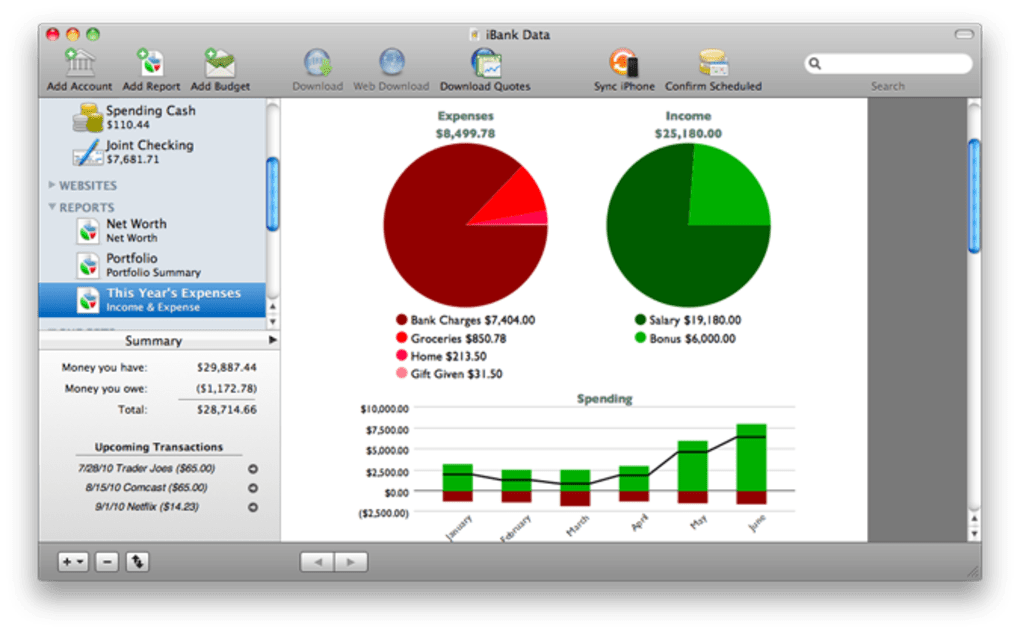

Ruff and tuff dealers. Another alternative is iBank. This $60 program (also available through the Mac App Store, free trial version available from company website) is far more capable than Quicken Essentials; like older versions of Quicken (and current Windows Quicken versions), it does far more than I need, promising the ability to manage a variety of account types, track loan interest and payment schedules, manage multiple accounts, download transactions directly from many financial institutions, track investments, and much, much more.

iBank allows creation of simple reports.

While I don't need most of those features, it also allows report creation – from simple reports (like I need) on up.

And it imports Quicken QIF exported data files. And,unlike Quicken Essentials, it can do so while running on Lion. I was able to import the same data file that I'd previously used with Quicken Essentials.

iBank imports Quicken export files and runs in Lion, but be sure to export before you install Lion.

There's even an iBank Mobile iOS app ($5) that syncs with the Mac version over WiFi.

One oddity: With the same old Quicken data imported into both Quicken Essentials and iBank, the two applications show different totals – a difference of about $20. That puzzles me, but I'm prepared to live with it.

In any event, even with what I think are fairly minimalist needs, I'm finding iBank much more usable as a Quicken replacement than Intuit's anemic Quicken 'Essentials'.

But even though iBank can import older Quicken data while running in Lion, Mac users of an older Quicken version still need to remember to export the data from Quicken prior to installing Lion. After upgrading to Lion is too late!

A reader suggests that choosing the Category Summary icon under Reports in Quicken Essentials for Mac will produced the reports I need.

Keywords: #ibank #quicken #macquicken

Sep 01, 2020 Quicken for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you're not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less.

I switched to a Mac in early 2005 and although I don't see myself ever willingly going back to Windows at home (I use it at work), the one area that makes me wish I was on a PC is personal finance software. I've been a Quicken user since 2000 and have enjoyed the benefits of easily tracking my spending, budgeting, online bill pay and cash flow forecasting for almost all of my adult life. I can still remember pondering the switch to Mac and thinking, 'oh great, they have Quicken for Mac.' But that was the last time I thought of a product from Intuit in a positive light. Converting from Quicken for PC to Mac was one of the most difficult software migrations I've ever done — and I do them for a living. I spent countless hours on the phone with support trying to figure out why my registrars didn't balance when I imported my qif files — no, Intuit doesn't support a direct import, but rather you export everything and import it back in. In the end I made the transition and missed the superior PC version of Quicken, holding my breath as Intuit released paid upgrades to its Mac product, only to realize none of my beefs were addressed.

But hey, at least it worked and it had many of the same features I had in the PC world, that was until Lion came along. Faced with the choice to upgrade to Quicken Essentials or to not upgrade to Lion, I bit the bullet and hoped for the best. That hope was unfounded as I lost access to one of my favorite features, online bill pay. For the past 10 years I've entered a transaction into Quicken and had it paid by my bank automatically, but not anymore. Now I have to enter the transaction into my bank's website and then enter it again into Quicken — if I wait for the transaction to clear, which will enter it automatically, I don't have the ability to forecast my cash flow. That is bad enough, but the budget tool in Quicken Essentials does not work, I won't go over the details here, but the issues are well documented in the Intuit community forums.

And so last month I decided to get serious about budgeting and while a spreadsheet does a pretty decent job at a high level, tracking my day-to-day spending against the budget on a spreadsheet is anything but workable. At first I tried HomeBudget for the iPhone and while it was ok, I found it tedious to enter each transaction manually since it doesn't link to my bank account. Then there was the Mint upgrade this month, which added budget features, so I figured now was a time to try it again. Mint is actually pretty good at keeping tracking of spending with a great iPhone app and website. I can quickly open it on the go and categorize my spending and see how I'm doing vs my goals in that category. I haven't tried it a whole month yet, but I'm hopeful it'll fit this specific need. The problem is, it only fits this one need, and not all my needs as it doesn't do cash flow forecasting, at all, or bill pay. I can't even work on a budget until the month begins — typically I like to get it worked out at least a few days in advanced.

So here I am over two years after Quicken Essentials was released realizing that Intuit is never going to fix it, never going to add online bill pay and never going to add an iPhone app that syncs automatically. So instead I'm using four applications to do what I used to do with a single app (bank site for bill pay, Quicken Essentials for cash flow forecasting and reconciliation, Mint to track day-to-day spending, and Google Docs for my monthly budget).

Convert From Ibank To Quicken For Mac Os

In July, I wrote in Using Quicken for Mac? Read This Before You Upgrade to Lion about issues that I – along with any Mac user running an older copy of Intuit's Quicken personal finance software – would be having when upgrading to OS X 10.7 Lion.

Migrating to Quicken Essentials

Briefly, Lion no longer includes Rosetta, Apple's software that, in previous versions of OS X, allowed Intel Macs to run software created for earlier PowerPC Macs. Although all Macs have used Intel CPUs since 2006, Intuit coded all Mac versions of Quicken prior to the current Quicken Essentials 2010 for PowerPC. Moreover, the Quicken File Exchange utility included with the current version of Quicken – used to import data from earlier versions or Windows versions – is also compiled for PowerPC Macs. As a result, Quicken 2005 (which I was running), Quicken 2007, and the Quicken File Exchange utility won't run on a Mac running Lion.

Intuit has not been especially helpful to its Mac user base; the company's advice to users with this problem is to open an account with Intuit's Mint.com online financial service. The problem: It doesn't import existing financial data. Otherwise, Intuit suggests users install Windows on their Mac (perhaps using one of several virtualization programs) and run the Windows version of Quicken.

Intuit does have a Mac product, Quicken Essentials 2010, which will run under Lion – and which will import Quicken 2007 exported data, as long as the data is imported into Quicken Essentials prior to installing Lion Hp zr30w specifications. (since, as I mentioned above, the Quicken File Exchange utility requires Rosetta, and hence won't run under Lion).

In the July article, I walked users through the process I went through of exporting and importing my Quicken data – something that I did prior to upgrading to Lion.

Disenchanted with Quicken Essentials

Although I was able to successfully import my financial data into Quicken Essentials, I quickly became disenchanted with the program.

Convert From Ibank To Quicken For Mac Online

My needs in financial software are fairly basic. I need something that lets me enter expenses and income, keeping a balance, and assigning each item into a category. Quicken Essential does this fine.

Quicken Essentials 2010 for Mac

But I also need to be able to create a report for each year, showing my expenses and income by category, and totaling each category. This is helpful when filing my income tax return.

And unlike the 2005 version of Quicken I was previously using, Quicken Essentials 2010 doesn't let me do that. It has a menu item labeled Export Tax Report – but that creates a report that can be used only by Intuit's companion TurboTax software, and only in the US. (I'm in Canada.)

I could, I discovered, display just the current year's transactions, then export to CSV (Comma Separated Values) format, a standard text file format that can be imported into a spreadsheet like Microsoft Excel. In Excel, I could sort the data by category, then manually total up each category, and eventually end up with something approximating the reports that I could quickly create in the earlier version. But that's a lot of effort.*

(It's not like this is a particularly advanced requirement. Prior to using Quicken 2005, I was a running the 3.0 version of Microsoft Money, a piece of Windows software so old that it shipped on a single floppy diskette.)

Luckily, Quicken Essentials 2010 ($50) is not the only option for Lion users.

iBank

Ruff and tuff dealers. Another alternative is iBank. This $60 program (also available through the Mac App Store, free trial version available from company website) is far more capable than Quicken Essentials; like older versions of Quicken (and current Windows Quicken versions), it does far more than I need, promising the ability to manage a variety of account types, track loan interest and payment schedules, manage multiple accounts, download transactions directly from many financial institutions, track investments, and much, much more.

iBank allows creation of simple reports.

While I don't need most of those features, it also allows report creation – from simple reports (like I need) on up.

And it imports Quicken QIF exported data files. And,unlike Quicken Essentials, it can do so while running on Lion. I was able to import the same data file that I'd previously used with Quicken Essentials.

iBank imports Quicken export files and runs in Lion, but be sure to export before you install Lion.

There's even an iBank Mobile iOS app ($5) that syncs with the Mac version over WiFi.

One oddity: With the same old Quicken data imported into both Quicken Essentials and iBank, the two applications show different totals – a difference of about $20. That puzzles me, but I'm prepared to live with it.

In any event, even with what I think are fairly minimalist needs, I'm finding iBank much more usable as a Quicken replacement than Intuit's anemic Quicken 'Essentials'.

But even though iBank can import older Quicken data while running in Lion, Mac users of an older Quicken version still need to remember to export the data from Quicken prior to installing Lion. After upgrading to Lion is too late!

A reader suggests that choosing the Category Summary icon under Reports in Quicken Essentials for Mac will produced the reports I need.

Keywords: #ibank #quicken #macquicken

Short link: http://goo.gl/jnr0m3

Convert From Ibank To Quicken For Mac Free

searchword: ibank